Any business that buys and sells products has inventory. eCommerceComing Soon to a Browser Near You! businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or distributor at on price. Then they sell the same products to their customers at a higher price. The wholesale pricing is lower as justified by quantity or volume discounts.

When the pandemic started, many retail businesses were forced to go online and become eCommerceComing Soon to a Browser Near You! businesses if they hadn’t already been doing that. The eCommerceComing Soon to a Browser Near You! business in the US alone is expected to surpass $1 Trillion in 2022.

When inventory is purchased it is an asset. This means it is owned by the retailer until such time as they sell it.

When inventory is sold, its cost moves from the inventory asset account to the cost of goods sold account. Meanwhile, the amount it was sold for is your revenueThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance…. Subtract that cost of goods sold from the revenueThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance… and you have your Gross ProfitThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance….

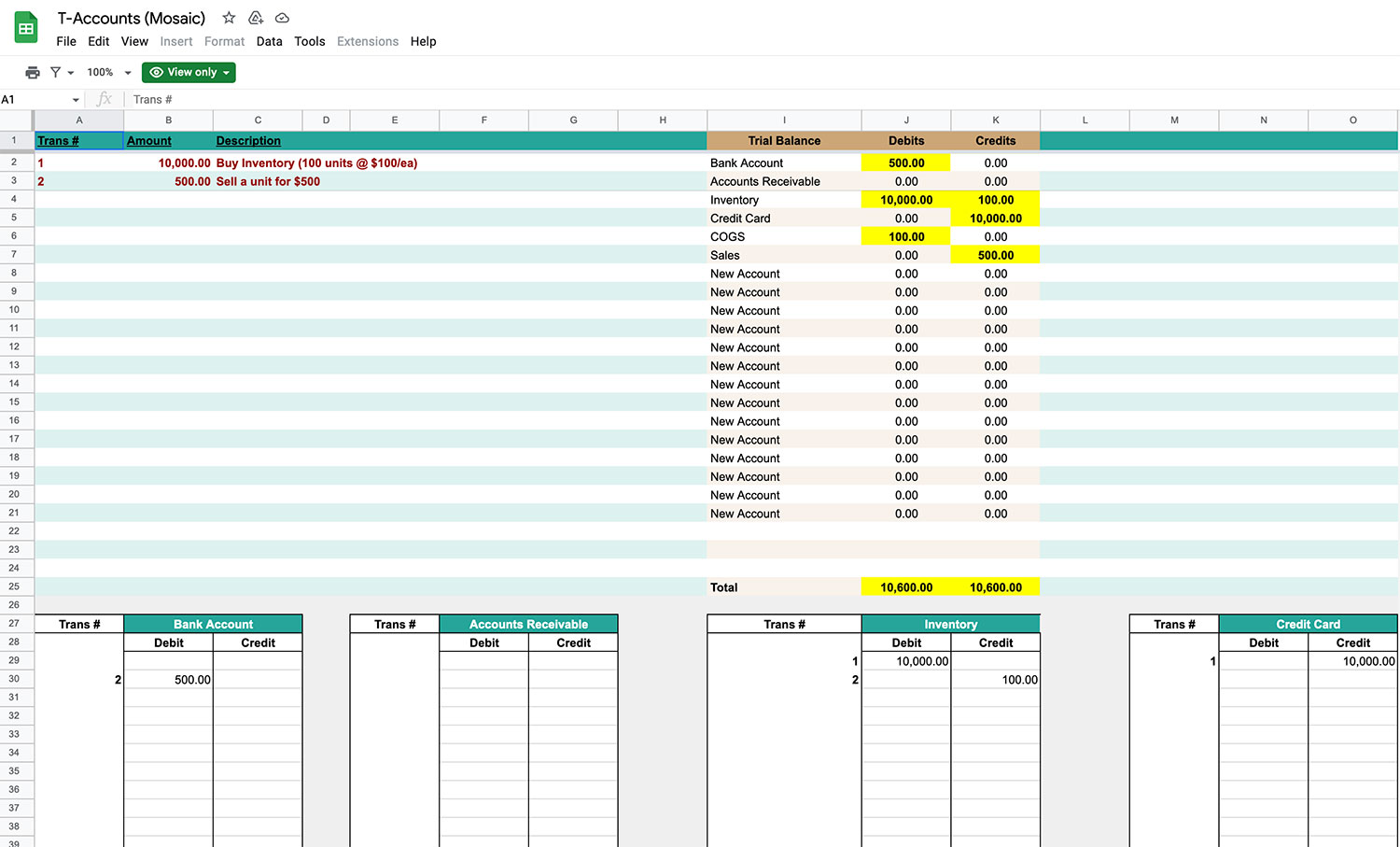

Let’s say you buy 100 units of a product for $100/each = $10,000 and you charge it on your credit card.

Your entry would be:

- Debit Inventory Asset $10,000

- Credit Credit Card Payable $10,000

Now you sell 1 unit for $500 (nice markup!)

This entry is a little more involved because you have 4 pieces.

- Credit Sales $500

- Debit COGS $100

- Credit Inventory Asset $100

- Debit Cash $500

Your accounting software does the debits and credits for you, but if you can learn accounting at this level, you will have a better understanding of what your accounting software is supposed to do, and how everything should look on your balance sheetComing Soon to a Browser Near You and income statement.

Inventory Assemblies

Inventory Assemblies are where we get into manufacturing. In the first example, we have a retailer who buys units at one price and sells them at another.

When you buy the parts and then you assemble them to create a finished product, you have manufacturing aka assemblies.

Depending on the product your assembly process may be very quick. In cases like this, your inventory goes straight from Raw Materials to finished goods.

If you have a longer manufacturing process, then at any given time you have inventory in 3 stages of production:

- Raw Materials

- Work In Progress

- Finished Goods

Raw Materials Inventory

These are the components you buy so you can assemble or manufacture your finished product. This can be as detailed as screws, wood, brackets, etc… that you might buy to assemble a piece of furniture. To understand all of the raw materials needed you have to understand the Bill of Materials (see below) for the finished product.

Work in Progress Inventory

This is the inventory that has been transferred from Raw Materials to begin production, but production is still ongoing. Once a unit is completed, its cost transfers to Finished Goods Inventory. It may be difficult to determine exactly how much inventory is in this stage at a given time. The best way to estimate this is to ask how many units are currently in production. Then use the Bill of materials to figure out how much raw materials there are in the WIP stage of production.

Finished Goods Inventory

Finished goods inventory is your finished products that are now sitting on the shelf waiting to be sold and shipped off to your customers. This would be the assembled piece of furniture. Once your inventory is in this stage, then the process of managing the inventory is the same as the simple inventory model from here forward. All of the costs of your raw materials have transferred to finished goods.

One issue may be that as part of the production process some volume is lost. A good example is grain production.

Shrinkage

Shrinkage is what happens when the yield of the manufacturing process is less than the sum of the parts. If you are manufacturing grains, for example, the processing of those grains may burn up a certain portion of them. So 25,000 lbs going in may wind up as 20,000 lbs of finished goods.

Shrinkage is also used to refer to inventory that breaks or simply disappears unaccounted for. Many companies use a Shrinkage account in COGS to keep track of this cost.

Bill of Materials

The Bill of Materials (BOM) is the recipe. It defines how many pieces of each raw material it takes to assemble 1 unit of the finished product.

Let’s say we were assembling a bridge table.

Here’s what the BOM might look like:

- 4 Legs

- 1 Table Top

- 16 screws (4 per leg)

This is simplified of course, but this should give you an idea.

Every table you assemble will require those items in those quantities.

Cost of Goods Sold

In the examples above your COGS would be based on the direct costs of purchasing the inventory that was sold. There are other costs that can be included in COGS.

COGS is defined as the costs necessary to get the goods ready for sale. Once the sale is made, any costs associated are now selling expenses and not cost of goods sold.

More examples of COGS would be labels, price tags, warehouse rent, utilities, and labor costs. Anything you spend money on as part of the process of getting the items ready to be sold. If your entire headquarters is in the same facility, then you take the sq Ft of the warehouse portion divided by the total sq ft, and that is the percentage of rent and utilities that you can allocate to COGS.

Freight-IN

One significant part of COGS can be Freight-IN. This is the shipping you pay for to get the inventory into your warehouse. Freight-OUT is the shipping out to your customers. Since the sale has already taken place, this is not included in COGS. It is a selling expense.

If you ship your inventory in from another country, you will have a logistics company that handles the shipping for you and charges you. The logistics company charges by weight, so you have to take this into consideration if you are going to use absorption costing to increase the inventory unit costs. For this reason (the complexity) many companies will use assumptions about the logistics costs.

Pre-paid Inventory

If you are shipping your inventory in from overseas, you likely have to prepay in full before they will ship. These payments and the logistics costs will then go into a pre-paid inventory asset account.

When the inventory is received, the pre-paid inventory is transferred to the inventory asset. If you do not use absorption costing for the logistics costs, then an assumption has to be made about the rate at which those pre-paid inventory costs are amortized to Cost of Goods Sold.

Absorption costing is required under GAAP.