There are 5 major account types in a company’s Chart of Accounts:

- Assets

- LiabilitiesComing Soon to a Browser Near You!

- Equity

- Revenue

- Expenses

The first 3 make up the Balance SheetComing Soon to a Browser Near You.

The last 2 make up the Profit and Loss.

Every other type of account falls into one of these categories.

The Balance Sheet

The Balance SheetComing Soon to a Browser Near You consists of Assets, LiabilitiesComing Soon to a Browser Near You!, and Equity. There is a formula that is expressed by the balance sheetComing Soon to a Browser Near You that works as follows:

Assets – LiabilitiesComing Soon to a Browser Near You! = Equity.

But that is not how the balance sheetComing Soon to a Browser Near You is presented. The presentation of a balance sheetComing Soon to a Browser Near You is based on a slight algebraic adjustment of the above formula:

Assets = LiabilitiesComing Soon to a Browser Near You! + Equity

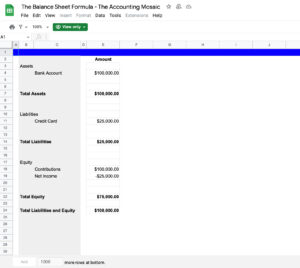

If a business owner starts off the business with a contribution of $100,000 and spends $25,000 on a credit card resulting in $25,000 of expenses and assuming no income yet, this is what their balance sheetComing Soon to a Browser Near You will look like:

Notice that the Total Assets exactly equals the sum of Total LiabilitiesComing Soon to a Browser Near You! and Equity. This is how you make sure your balance sheetComing Soon to a Browser Near You is balanced.

Accounting software does this for you, but it is important to understand what is going on here so you can better understand your balance sheetComing Soon to a Browser Near You.

Assets

Assets are things you own or have rights to. You own the money in your bank accountComing Soon to a Browser Near You, and you have the right to collect your accounts receivableComing Soon to a Browser Near You!

Within Assets you have many subsets of asset account such as:

- Bank Accounts

- Accounts ReceivableComing Soon to a Browser Near You!

- Fixed AssetsComing Soon to a Browser Near You!

- Intangible Assets

- InventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or…

- Prepaid InventoryComing Soon to a Web Browser Near You!

- LoansComing Soon to a Browser Near You! Receivable

- Notes Receivable

- Prepaid ExpensesComing Soon to a Web Browser Near You!

There are more examples, but this should give you a good idea of the range.

Liabilities

LiabilitiesComing Soon to a Browser Near You! are obligations as in amounts you owe to others.

As with assets there are many sub-types of liability accounts. Here are some examples:

- Accounts PayableComing Soon to a Browser Near You

- Credit Cards Payable

- Customer Deposits / Deferred Income

- Notes Payable

- LoansComing Soon to a Browser Near You! Payable

- Sales Taxes Payable

- Payroll Taxes Payable

Short Term vs Long Term classification

In both assets and liabilitiesComing Soon to a Browser Near You!, you have “current” and then non-current. This classification has a very specific distinction as defined by 1 year. If a loan (either receivable or payable) is not coming due within 1 year, it is classified as long-term.

In companies who need to keep their financials according to Generally Accepted Accounting Principals (GAAP)Coming Soon to a Browser Near You! long-term loansComing Soon to a Browser Near You! have to be broken up into the “current portion” that is coming due within a year, and the long-term portion, which is the rest.

This has important implications when investors are analyzing a company. Some Financial RatiosComing Soon to a Browser Near You! they look at, such as the Quick Ratio and the Current Ratio leave the long-term assets and liabilitiesComing Soon to a Browser Near You! out of the equation. This gives investors a measure of liquidity based on what can be liquidated quickly if needed.

Equity

Equity account naming will vary based on the type of company.

Corporations and S-Corps have Shareholders.

LLCs have Members

Partnerships have partners

Sole proprietors have Owners

Using Corporations as the example, where applicable, here are examples of Equity Accounts:

- Shareholder’s Equity

- Shareholder Contributions

- Shareholder Distributions

- Common Stock

- Preferred Stock

- Capital Stock

- Restricted Stock

- Retained Earnings

The Equity in a company represents its “Book Value.” If you add up all of your assets and subtract all of your liabilitiesComing Soon to a Browser Near You! (everything you own, minus everything you owe) then you have your total equity or book value.

The Income Statement or the Profit and Loss

Revenue / Sales / Income

The income statement can be as simple as a single account called, “Sales” and it can get infinitely more complex.

You can have sales accounts for different product lines.

Then sales returns and allowances (as a contra-income account – see below)

Then you’ll have net sales (sales – returns and allowances).

The way you set up this part of your chart of accounts depends entirely on how you want this information presented on your income statement.

Cost of Goods Sold

Many people think this is its own account type. Technically Cost of Goods Sold is a contra-income account. It goes against income. The purpose of Cost of Goods Sold is to take the cost of the inventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or… you’ve purchased and match it with the revenue from the inventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or… that was sold in the same period.

Cost of goods sold is defined as the costs necessary to get goods ready for sale. In other words, these costs happen before the sale is made. A common argument is over whether shipping is included in cost of goods sold. The answer is both. Freight IN is cost of goods sold, because it happens before the goods are sold. Freight OUT is a selling expense because that doesn’t happen until after the sale is made.

The costs that transfer from the InventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or… Asset account on the balance sheetComing Soon to a Browser Near You will often be labeled as “Cost of Goods Sold.” Generally, this is what you paid for the units of inventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or… that were sold.

Other accounts you might find here would include things like logistics costs, labels, and labor if required for the production of the inventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or…. Depending on the complexity and the needs of the business, these other costs might be absorbed into the cost of inventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or…. In many cases, especially with smaller businesses, this is not practical as the accounting costs for doing it would be too high.

Cost of Goods Sold in a service-based business

You will find that many service-based businesses use Cost of Goods Sold to describe expenses that are directly related to the production of revenue. A bookkeepingComing Soon to a Browser Near You firm, for example, might put its bookkeeper’s salaries in the COGS section so they can analyze the Gross Profit based on the revenues generated from bookkeepingComing Soon to a Browser Near You services less the “direct” cost of providing those services.

When you look at a tax return for a company like this, you will note that the COGS from the income statement are not classified as COGS on the tax return. Tax preparers understand what the business is doing for reporting purposes, but for tax purposes, they reclassify these costs as operating expenses.

Gross Profit

You might think of this as an “account type” but it isn’t. It is simply a calculation based on net sales – cost of goods sold. This is almost always analyzed as a percent of sales.

Expenses

Expenses are everything you have to pay to run the business from Advertising to Utilities. This section will often be organized in sub-sections such as “Office Expenses” where you would have sub-accounts for things like Office Supplies, Office Equipment (Minor), Cleaning, etc…

The distinction between “minor” expenses and “major” is the difference between an expense and a fixed asset. For many years the threshold used for this was $500. As the rules have changed you will find businesses using something more like $2,500.

Other Income / Expenses (Extraordinary Items) aka Below The Line

The definition of an “Extraordinary Item” is based on something you never expected to happen, and now that it has happened, you still never expect it to happen again. An example of this would be some sort of litigation settlement. Another example would be damage from an event that doesn’t normally happen in that area. So repairs based on damage from a tornado in an area where there are normally tornados is not “extraordinary” but if they don’t normally happen then it would be.

The other accounts you will find in this section are, Interest, Taxes, Depreciation, and AmortizationComing Soon to a Browser Near You. By categorizing these accounts in this section, your Net Operating Income becomes your EBITDA (Earnings Before Interest, Taxes, Depreciation, and AmortizationComing Soon to a Browser Near You).

Contra Accounts

Contra is a word that means, “goes against” and you will find certain accounts in the financial statementsComing Soon to a Browser Near You! that go against the accounts in the same section. Below are some explanations of common contra accounts that you will find in many business’ chart of accounts.

Contra Income / Revenue Accounts

Sales Returns and Allowances is a contra-revenue account and would be numbered in such a way that it shows up directly underneath Sales.

Cost of Goods Sold (COGS) is actually a contra-revenue account because it goes directly against revenue. The difference between COGS and other contra revenue accounts is that COGS has it’s own classification on the profit and loss statement.

Purchase discounts and allowances is a contra-COGS account. This is commonly seen in retail accounting as is Sales Returns and Allowances.

Contra-Assets

Within Fixed AssetsComing Soon to a Browser Near You!, you will also find Accumulated Depreciation and AmortizationComing Soon to a Browser Near You. These are contra (they go against) assets. These have a normal credit balance and therefore will be negative on the balance sheetComing Soon to a Browser Near You.

Allowance for Doubtful accounts is a contra-asset – it goes against accounts receivableComing Soon to a Browser Near You!. This is an account that is used for GAAP-compliant businesses to estimate bad debt.

Conclusion

It is important to remember that your chart of accounts drives how your balance sheetComing Soon to a Browser Near You and profit and loss statements will look. The goal of the financial statementsComing Soon to a Browser Near You! is to present the financial position and performance of the company. The chart of accounts should make that easy to ascertain.