Depreciation Expense

When you purchase something “major” like a piece of machinery or equipment you do so because of the long term benefit you will derive from that “Fixed Asset.”

Since the benefit will last more than one year, you want the deduction for that expenditure to last more than one year in order to match the appropriate portion of the expenditure with the related production of RevenueThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance….

This is what depreciation is meant to accomplish.

When a fixed asset is purchased, the entire amount is recorded as an Asset as opposed to an Expense.

Useful Life and Salvage Value

Then (usually at tax time) a useful life is determined and if applicable salvage value. Then the cost is divided over that life. This is what is known as Straight Line depreciation.

Accumulated Depreciation

As you book depreciation expense each year, you accumulate that amount in a Contra-Asset account called, “Accumulated Depreciation.” This preserved the asset’s original cost on the balance sheetComing Soon to a Browser Near You, and deducts the accumulated depreciation. The net of these two accounts is the Book Value of the asset.

Section 179

In many cases for tax purposes the entire amount will be deducted in the first year under. This is a special election a business can make to take advantage of the full expenditure as a deduction in the first year. Most companies will elect to do this for the tax benefits.

In 2018 the IRS updated the rules for Section 179This is a special election a business can make to take advantage of the full expenditure as a deduction in the first year. Most companies will elect to do this… under the Tax Cuts and Jobs Act. Specifically they raised the limit from $500,000 to $1,000,000. It also increases the phase out thresholds from $2 million to $2.5 million. The changes also broaden the scope of what can be deducted under Section 179This is a special election a business can make to take advantage of the full expenditure as a deduction in the first year. Most companies will elect to do this…. For property placed in service after 12/31/17 you can deduct interior improvements as long as they aren’t attributable to the enlargement of a building, any elevator or escalator, or the internal structure of framework of the building. Roofs, HVAC, fire protection systems, alarm systems and security systems are also an exception to what can be included for improvements under Section 179This is a special election a business can make to take advantage of the full expenditure as a deduction in the first year. Most companies will elect to do this….

One temptation might be to record these asset purchases straight to an expense, but this is not proper form, and you could lose the Section 179This is a special election a business can make to take advantage of the full expenditure as a deduction in the first year. Most companies will elect to do this… benefit. You have to book the purchase to the asset account, and then record the depreciation entry.

MACRS (Tax Only Method of Depreciation)

When section 179This is a special election a business can make to take advantage of the full expenditure as a deduction in the first year. Most companies will elect to do this… is elected, the depreciation expense for that item includes the entire amount of what was purchased. Otherwise, depreciation is calculated and recorded for tax purposes based on the MACRS (Modified Accelerated Cost Recovery System).

Most small businesses will want to record depreciation on the “Tax” basis, meaning MACRS or Section 179This is a special election a business can make to take advantage of the full expenditure as a deduction in the first year. Most companies will elect to do this…. As the business grows and priorities change, such as wanting financing form banks of venture capital, this can change because accelerated methods of depreciation reduce assets more quickly which weakens the balance sheetComing Soon to a Browser Near You. Also recording more depreciation expenses reduces net income, and when seeking financing the goal is to show more income. On this basis a company may elect to record depreciation on the Straight Line basis to lower the deductions and increase net income.

Accrual vs Cash Basis Implications – Depreciation

If the company is filing taxes on an accrual basis, this will mean they pay more taxes. If they file on a cash basis then depreciation expense is irrelevant. For tax purposes the company would deduct the entire amount of any assets purchased in the year purchased.

Modified Cash Basis and Depreciation

On a pure cash basis, companies don’t have depreciation because the assets the purchase are booked straight to an expense account at the time of purchase. There is no asset, therefore no depreciation.

Modified cash basis allows you to have a hybrid of accrual and cash basis This is not applicable to publicly traded companies (GAAP), but for smaller businesses you can elect “modified cash basis” which let’s you report your short terms assets like Accounts ReceivableComing Soon to a Browser Near You!, and InventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or… on a cash basis, and long term assets like fixed assetsComing Soon to a Browser Near You! (and the related depreciation) on an accrual basis.

In a manner of speaking this is the “best of both words” but there are advantages and disadvantages.

The main advantage is as stated above, that you can pick up your income and expenses based on when they were paid (so you don’t pay taxes on income you haven’t received).

The main disadvantage is that this method will not fly if you need an audit or if your financial statementsComing Soon to a Browser Near You! are subjected to any kind of scrutiny for lending or investing purposes.

Available Methods of depreciation

Straight Line

We’ve mentioned Straight Line depreciation which is the most common. This method simply takes the cost of the asset and divides it by the useful life of the asset.

Double Declining Balance

Double Declining Balance takes twice the straight line amount and depreciates that amount until the asset is fully depreciated. You can also use another accelerated rate in which case you are using Declining Balance.

Sum of Years Digits

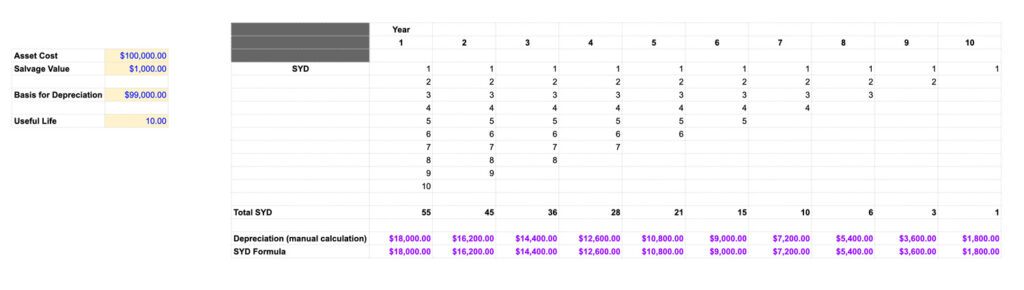

This method is taught in schools but it is rarely if ever used in practice. This method is useful for companies who believe their assets will decline in value more in earlier years instead of later. At any given point, the depreciation is calculated based on the remaining life span divided by the sum of the years. Then this is multiplied by net of cost – salvage value.

Example: If you purchase an asset this year for $100,000, and it’s useful life is 10 years with a salvage value of 1,000, the formula would work as follows:

Units of Production Method of Depreciation

This method of depreciation assumes that an asset’s useful life is based on output instead of time. If you have a machine that is warrantied to produce 50,000 units, then you want to book depreciation based on units of output instead of time.

The formula is the (cost-residual value)/total estimated units of production * actual units of production.

See “Units of Production Method” tab for an example.