The Chart of Accounts is divided up into 5 major Chart of Accounts and Account TypesThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance....

If you are going to use account numbers in your chart of accounts, then it’s important to note that you have a number sequence associated with each and every account type based on the following generic numbering convention:

- Assets

- LiabilitiesComing Soon to a Browser Near You!

- Equity

- RevenueThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance...

- Expenses

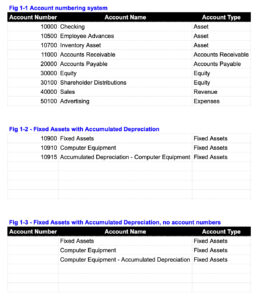

An overly simplified chart of accounts might look something like this:

- 10000 – Checking

- 10500 – Employee Advances

- 10700 – InventoryAny business that buys and sells products has inventory. eCommerce businesses by definition have inventory. If you look at a simple retail business, they buy products from a wholesaler or... Asset

- 11000 – Accounts ReceivableComing Soon to a Browser Near You!

- 20000 – Accounts PayableComing Soon to a Browser Near You

- 30000 – Equity

- 30100 – Shareholder Distributions

- 40000 – Sales

- 50100 – Advertising

- 50500 – Payroll Expenses

Use of Account Numbers

The use of account numbers in accounting has been around since the beginning of double entry accounting. There is much debate about whether or not the use of account numbers is still necessary in this day and age.

Account numbers in an accounting system give you more control over the order they appear in. This drives how things look on major financial reports such as the Balance SheetComing Soon to a Browser Near You, Profit and Loss, and Statement of Cash Flows.

Some argue that for this reason, the use of account numbers is necessary. Others argue that this was more useful in a paper-based accounting system where you didn’t have the help of computers and drop-down menus to find something quickly by name.

Accounting systems like QuickBooks Online will keep the accounts grouped by major category (assets, liabilitiesComing Soon to a Browser Near You!, Equity, RevenueThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance..., Expenses…) and then sort by name or number if used, within that.

An example of where the alphabetical sorting fails is in the fixed assetsComing Soon to a Browser Near You! section. “Accumulated Depreciation” lands at the top when you really want it at the bottom of that asset classification.

See figure 1-2 above.

Without the use of account numbers, many accountants have gotten creative with naming accounts. For example, naming an account, “Computer Equipment – Accumulated Depreciation” will cause it to fall below the initial fixed asset account, “Computer Equipment” under Fixed AssetsComing Soon to a Browser Near You!.

Another way to make this work without Account Numbers is to use a combination of creative naming and parent accounts with sub-accounts. In fact, this is a good way to organize the accounts in the Fixed AssetsComing Soon to a Browser Near You! section so that each Fixed Asset Category lines up with how they are grouped on a tax return.

A structure like this will give you the Assets’ combined original cost, accumulated depreciation, and the net book value of that asset classification. This will make things really clear on the balance sheetComing Soon to a Browser Near You.

The argument against the use of account numbers is based on it not being necessary when you can structure things as shown above and as mentioned earlier, in the computer age people will more likely be looking for things by name, rather than number when coding transactions in an accounting system.

Another argument against using account numbers is that you run out of space and then you need to renumber things to make room which creates extra work.

Another complaint about the use of account numbers is that you run out of space for new accounts in certain sections and then you have to renumber the accounts. One way to avoid this is to use a longer number sequence. Instead of 10000, add a zero to everything and make it 100,000. In any case, it’s probably best to start with 5 significant figures and not 4 (ie not 1,000).

In the end, it’s clear that there is no right or wrong answer here. Some people find account numbers useful, and some do not. Each company has to figure out its policy on this and decide what is best for the company taken as a whole.

Sales Returns and Allowances is a contra-revenue account and would be numbered in such a way that it shows up directly underneath Sales.

Cost of Goods Sold

The cost of goods sold is a “contra-incomeThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance...” account. Contra means, “it goes against.”

When you have Cost of Goods Sold Accounts to number, you might make 5000 your COGS section and 6000 your Expenses Section.

Purchase Discounts and Allowances would go in the same numbering sequence as Cost of Goods Sold, and placed appropriately using the numbering sequence underneath the COGS that were discounted.

Other Income / Expenses

For Extraordinary income items, you can use an 8000 series.

Accounts such as Interest, Taxes, Depreciation, and AmortizationComing Soon to a Browser Near You belong in Other Expenses and for this section use a 9000 series.

Contra-Accounts and Account Numbers

A contra account is an account that “goes against” something. For example, a contra income account goes against income. “Sales Returns and Allowances” is a contra income account. You can learn more about Contra-Accounts in the Chart of Accounts and Account TypesThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance....

As far as numbering contra accounts go, you would generally use the same numbering sequence as their original counterparts. If you are using 40000s for income, your contra-incomeThere are 5 major account types in a company’s Chart of Accounts: • Assets • Liabilities • Equity • Revenue • Expenses The first 3 make up the Balance... accounts would be in the same sequence, placed appropriately underneath the specific account that they go against.