A 1031 exchange is an exchange of “like-kind” property. This means the property you sell and the property you purchase have to be “similar.” You also have a limited time in which to purchase the like-kind property once you’ve sold one.

A 1031 exchange allows capital gains to be deferred, which means you don’t pay taxes on any gains until you sell the next property, without a like-kind exchange. In other words, you can keep this going until you are in a lower tax bracket and ultimately pay much lower taxes on it.

How is “like-kind” defined?

To be considered “like-kind” the properties only need to be alike in their nature or character. The properties themselves can be very different in fact, as to value, quality, and many other factors. “Like Kind” refers essentially to how the properties are used.

The properties have to be held for business use or investment purposes. In other words, you can’t do this with your primary residence. You can use a 1031 exchange on rental property, or property that you purchase to rehab and then sell.

Note: If you move out of your primary residence and rent it out, effectively converting it to a business use property, then you might be able to qualify it in a 1031 exchange.

Prior to Dec 2017 1031 Exchanges applied to many different kinds of property. Under the Tax Cuts and Jobs Act 1031 exchanges are now limited to real estate or “Real” property.

In order to have 100% of the gain deferred on a 1031 exchange, the investor needs to purchase a property that is equal to or greater in value than the property that was sold. If the value of the property that was purchased is less than the one sold, that difference will be taxable.

What is the time limit on a 1031 exchange?

Once the investment property is sold, you have 45 days to identify a property to purchase, and 180 days to acquire it. The investor can identify up to 3 properties (in some cases more) replacement properties.

Both windows start on the date of purchase.

Reverse Exchange

You can actually purchase the property first and then sell a property. The same windows apply in terms of the time limit. This means that from the date you purchased the property you have 45 days to identify the property you will sell and 180 days to sell it.

Boot

Boot is something of value other than the real estate itself, which may be exchanged. A common example would be if the investor received some cash or some other “not like-kind property” as part of the deal.

Taxes must be paid on Boot.

You should also take mortgages into consideration. If at the end of the exchange your mortgage is less, that difference is considered boot and is taxable.

A reduction of debt is the same thing as income, therefore taxable and this cannot be deferred in a 1031 exchange. In substance, it is as if you received cash (boot) in the exchange.

In other words, you sell a property with a mortgage payable of $1,000,000, and for the property, you purchase in the exchange, you wind up with a mortgage payable of $900,000. You will have a taxable gain of $100,000, and the rest or $900,000 can be deferred.

How to Apply / Qualify for a 1031 Exchange

A 1031 Exchange Qualified Intermediary

In order to ensure that your 1031 exchange is done properly, you are required to hire a qualified intermediary. This person will help you make sure that your transactions do qualify, and that everything is handled properly. You can search the internet for “1031 Exchange Qualified Intermediary” and you will find plenty of them. These can be individuals or companies who are not related in any way to the investor.

The qualified intermediary will make sure that the investor signs the necessary exchange documents before the relinquished property is transferred. If this is not done prior to closing, the sale of the original property will be treated as taxable, and the purchase will be treated as an independent subsequent purchase.

IRS Form 8824

The Form https://www.irs.gov/pub/irs-pdf/f8824.pdf

The Instructions https://www.irs.gov/pub/irs-pdf/i8824.pdf

This form is used to report the like-kind exchange.

Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like-kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

1031 Exchanges for Airbnb, Virbo (ie) short term rentals, and Vacation Homes

Short-term or long-term rentals are still rental properties which means they can be exchanged for other rental properties and take advantage of the benefits of a 1031 exchange. You can also exchange a short-term rental property for a long-term one as “like-kind” simply refers to the fact that in each case the property is used for some business purpose.

If you want to use a vacation home in a 1031 Exchange, similar to a primary residence you need to turn it into a rental property, and in order for this to work, you must have tenants renting the property. Putting it on the market as a rental alone is not enough.

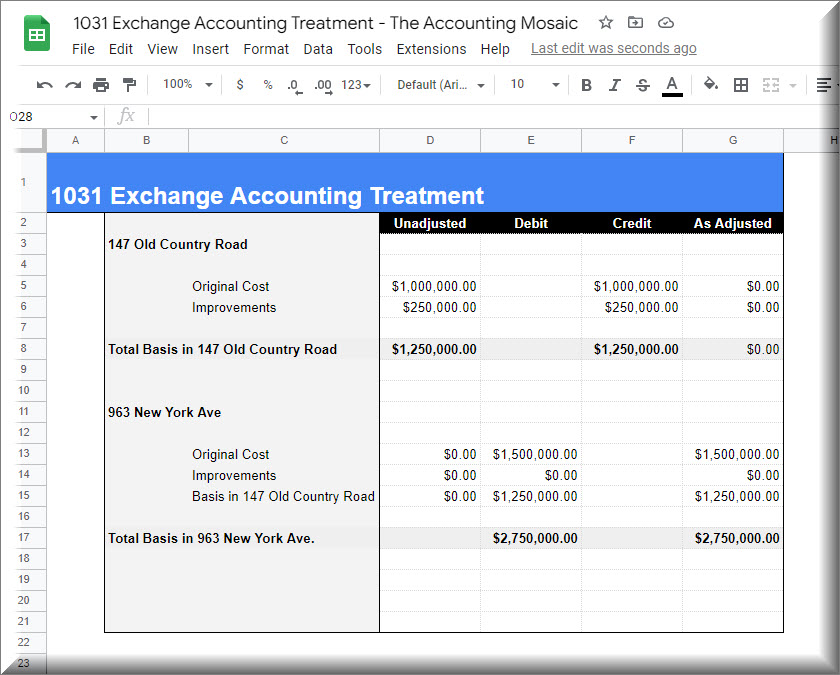

Accounting Treatment for a 1031 Exchange:

The basis transfers from the old asset to the new.

Let’s say you are selling your property at 147 Old Country Road, and you identify and purchase the property at 963 New York Avenue

The old property is zeroed out, and the basis transfers to the new one. It should look something like this: